🔬 Problem set beta#

\(\beta\).1#

Let \(f \colon [-1, 1] \to \mathbb{R}\) be defined by \(f(x) = 1 - |x|\), where \(|x|\) is the absolute value of \(x\).

Is the point \(x = 0\) a maximizer of \(f\) on \([-1, 1]\)?

Is it a unique maximizer?

Is it an interior maximizer?

Is it stationary?

Draw a graph of function \(f\).

⏱

\(\beta\).2#

Consider function \(f \colon X \to \mathbb{R}\) defined by \(f(x) = \frac{1}{x} e^x\).

Find the minimizer(s) and the maximizer(s) of this function on \(X = (0, 2]\).

Follow all the required steps and explain your reasoning.

Review the algorithm for univariate optimization in the lecture notes

⏱

\(\beta\).3#

Find an example of a nonlinear univariate function \(f \colon D \subset \mathbb{R} \to \mathbb{R}\) that:

(a) has exactly one maximizer and one minimizer (b) has has neither a maximizer nor a minimizer (c) has an infinite number of maximizers and minimizers (d) has exactly finite number \(n\) of maximizers and \(n\) minimizers

Remember to define both the function \(f(x)\) and its domain \(D\) for each case.

First, review the relevant definitions. Then, try to draft some ideas on a piece of paper. Think of how they can be expressed in mathematical terms.

⏱

\(\beta\).4#

A firm uses capital and labor to produce output. When it employs \(k\) units of capital and \(\ell\) units of labor, its output is \(A k^{\alpha} \ell^{\beta}\) units, where \(A\) is a positive number, and \(\alpha + \beta < 1\).

The unit price of capital is \(r\), and the unit price of labor is \(w\); both are non-negative. The firm would like to maximize the profits taking the price \(p\) of the output as given.

The firm’s chief economist Bob presented the following formulation of the firm’s optimization problem to the CEO Alice:

Questions:

Is this formulation of the firm’s optimization problem correct?

What part reflects the revenue?

What part reflects the costs?

What are the choice variables?

Are there any constraints to be taken into account?

Right down the problem after Alice have updated the formulation.

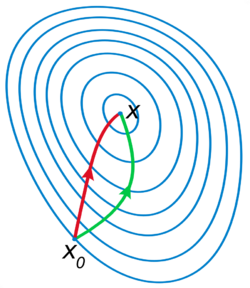

Approach the problem as unconstrained maximization, and follow the steps in the lecture to find find all stationary points (solve the FOCs).

Write down second order partial derivatives and verify the shape conditions for the profit function.

What is the optimal strategy for the firm? Is the maximizer unique? Why?

Review the algorithm for optimization of bivariate functions in the lecture notes

⏱