| 1 |

|

Course introduction. Housekeeping What is computational economics. Course structure and house keeping. Choice of programming language. |

|

| 2 |

|

Local workspace. Jupyter notebooks. Git and GitHub Introduction of Git version control system. Local installation of Python, Anaconda, Jupyter Notebooks, Git and Git GUI. GitHub and GitHub Classroom. |

|

| 3 |

|

Representing numbers in a computer Binary and hexadecimal numbers. Floating point numbers. Numerical stability and potential issues. Numerical noise. |

|

| 4 |

|

Python essentials: data types Variables and memory, binary operations, logical expressions, composite variables types. |

|

| 5 |

|

Python essentials: control flow and functions Flow control, user defined functions. Sieve of Eratosthenes example. |

|

| 6 |

|

Two simple examples Indexing problem and its inverse, base-N number conversion |

|

| 7 |

|

Python essentials: object-oriented programming Classes and objects. Attributes, properties. Encapsulation, inheritance and polymorphism. |

|

| 8 |

|

Bundle goods market Object oriented programming in modeling consumer choice model. |

|

| 9 |

|

Algorithms and complexity Timing of Python code. Runtime order of growth. Complexity classes. P vs NP. |

|

| 10 |

|

Two simple algorithms: parity and max Parity of a number, bitwise operations in Python. Finding maximum in an array. |

|

| 11 |

|

Binary search algorithm Binary search. Other divide and conquer algorithms. Recursion. |

|

| 12 |

|

Enumeration of discrete compositions Combinatorial enumeration. Python generators. |

|

| 13 |

|

Two very important algorithms for solving equations Bisections and Newton-Raphson methods. Solving equations of one variable. Accuracy of solution. Rates of convergence. |

|

| 14 |

|

Vectors and matrixes (Numpy) NumPy arrays data types and differences to native Python, operations on the arrays, solving linear systems of equations. |

|

| 15 |

|

Introduction to Data Manipulation in Python (Pandas) Introduction into DataFrames, grouping and data merging. |

|

| 16 |

|

Visualization of data and solutions Principles and functions of graphics. Examples of visualization of economic models. |

|

| 17 |

|

Linear regression using Pandas and Numpy Using Numpy and Pandas to estimate simple regression. |

|

| 18 |

|

Linear programming and optimal transport models Linear programming and optimal transport problems. |

|

| 19 |

|

Measuring the volume of illegal trade with linear programming Application of the optional transport problem. |

|

| 20 |

|

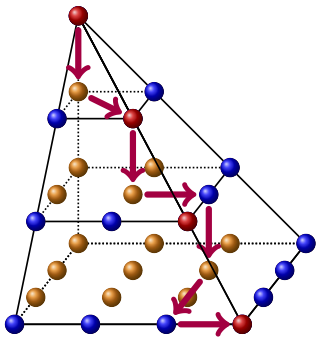

Finite Markov chains Stochastic matrix, irreducibility and aperiodicity, stationary distribution. |

|

| 21 |

|

Computing a stationary distribution of a Markov chain Successive approximations and direct linear solver. |

|

| 22 |

|

Successive approximations (fixed point iterations) Scalar and multivariate solver. Equilibrium in market of platforms. |

|

| 23 |

|

More on Newton-Raphson method Failures of Newton method, domain of attraction. Multivariate Newton for optimization problems. |

|

| 24 |

|

Optimization through discretization (grid search) Grid search method and its use cases. |

|

| 25 |

|

Newton-Raphson method with bounds Robust implementation of Newton method for problems with strict bounds. |

|

| 26 |

|

Polyline class for piecewise linear curve approximation Precomputation of complex curves in the equilibrium model (coding from scratch). |

|

| 27 |

|

Dynamic programming in discrete world Backwards induction. Tiling problem. Deal or no deal game. Bellman optimality principle. Inventory dynamics model. |

|

| 28 |

|

Rust model of bus engine replacement Model background and formulation. Mileage process. Optimal replacement choice with and without EV taste shocks. |

|

| 29 |

|

Coding up the Rust model of bus engine replacement Implementation of Rust model in infinite horizon with value function iterations solver |

|

| 30 |

|

Cake eating in discrete world Cake eating problem setup. Solution “on the grid”. |

|

| 31 |

|

Function approximation in Python How to approximate functions which are only defined on grid of points. Spline and polynomial interpolation. |

|

| 32 |

|

Cake eating model with discretized choice Using function interpolation to solve cake eating problem with discretized choice. |

|

| 33 |

|

Random numbers in Python, Monte Carlo Random number generation in Python. Inverse transform sampling. Monte Carlo simulations. |

|

| 34 |

|

Numerical integration, quadrature Gaussian quadrature. Monte Carlo integration. |

|

| 35 |

|

Stochastic consumption-savings model with discretized choice Deaton model of consumption and savings with random returns. Using quadrature to compute the expectation in the Bellman equation. |

|

| 36 |

|

Simulating data from the model Random variables induced by the model. Coin flipping example. Simulating consumption and wealth paths from the consumption-savings model. |

|

| 37 |

|

Dynamic programming theory and overview of solution methods Overview of dynamic programming problem formulations and solution methods. Theoretical foundations of dynamic programming in infinite horizon. Contraction mappings and fixed points. |

|

| 38 |

|

Dynamic programming with continuous choice Optimization in Python. Consumption-savings model with continuous choice. |

|

| 39 |

|

Euler equation and time iterations First order conditions and Euler equation. Time iterations solution method. Euler residuals for measuring the accuracy of solution for consumption-savings model. |

|

| 40 |

|

Consumption-savings model with continuous choice Adding continuous version of Bellman operator and time iterations solver to the consumption-savings model. Measuring accuracy of different solutions. |

|

| 41 |

|

Endogenous gridpoint method (EGM) Fastest and most accurate solution methods for consumption-savings model. Class of models solvable by EGM. Generalizations of EGM method. |

|

| 42 |

|

Solving consumption-savings model with EGM Implementation of endogenous gridpoint method for solving Deaton’s consumption-savings model. |

|

| 43 |

|

Solving DP problems with policy iterations Policy iterations solution method for infinite horizon dynamic models. Solving stochastic inventory management problem with policy iterations. |

|

| 44 |

|

Newton-Kantorovich method Solving Bellman equation using Newton-Kantorovich iterations. Convergence rates. Polyalgorithm. |

|

| 45 |

|

Method of simulated moments for model estimation (MSM) Using data to inform numerical economic models. Calibration and estimation of economic models. Introduction to method of simulated moments (MSM). |

|

| 46 |

|

Nested fixed point maximum likelihood estimator (NFXP) Nested loop MLE estimator. Combining Newton-Kantorovich iterations with gradient based likelihood maximization. Structural estimation of Rust bus engine replacement model. |

|

| 47 |

|

Example exam questions Examples of questions and answers in the exam. |

|

and practical lab sessions

and practical lab sessions  are available through GitHub, and can be launched on Binder.

are available through GitHub, and can be launched on Binder.